Private assets are perking up a stagnant capital market amid robust retail interest, but challenges lie ahead in risk and liquidity management to integrate the new investor group, a new report finds.

The muted public capital market, which has seen a spate of delistings, has prompted retail investors to look for opportunities elsewhere, says a recent Moody’s report on private credit. Alongside higher returns favoured by retail investors, this asset class is getting a boost from asset managers and regulators who provide depth to the market.

As first movers, Apollo and State Street teamed up to launch the first exchange-traded fund ( ETF ) with part of the portfolio invested in private credit. In 2024, BlackRock set aside US$27 billion, or 2% of its assets, for private-market-related acquisitions, suggesting growing opportunities in the sector.

While retail investors scale their presence in private markets, they risk paying a steep price if they fail to adequately navigate risks related to liquidity, accessibility, and affordability, the report says.

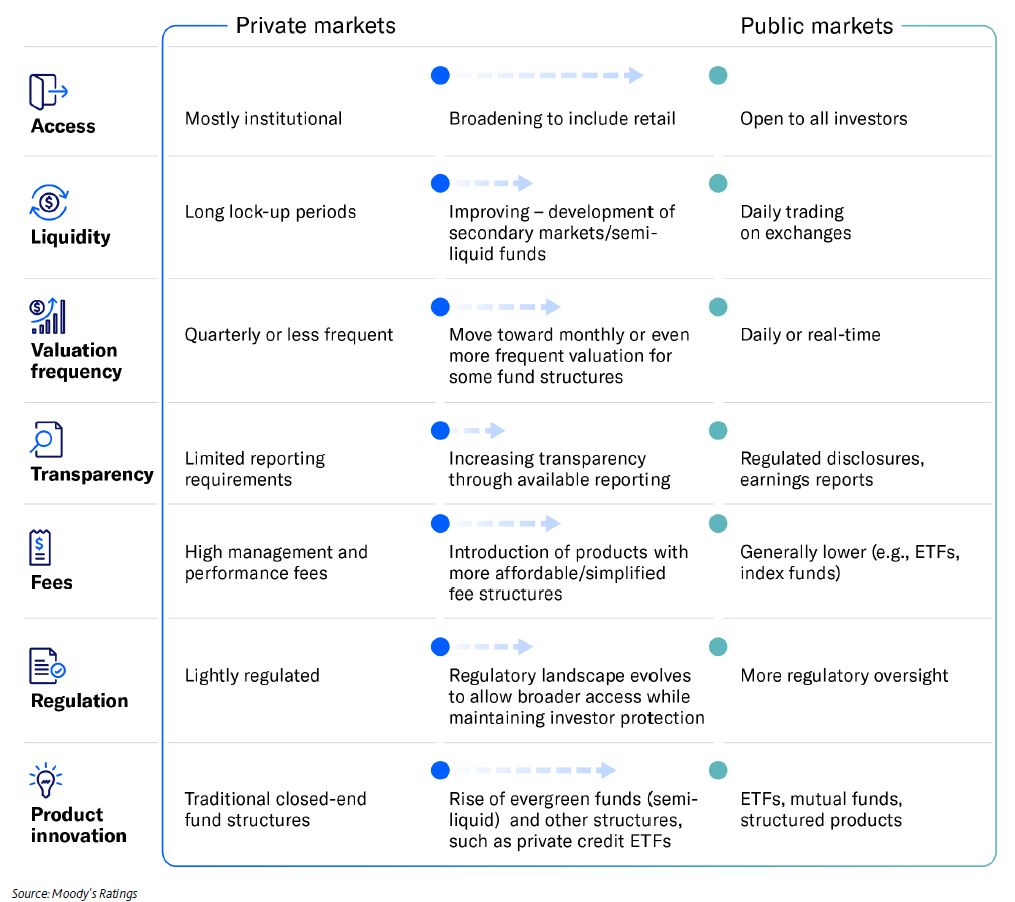

The illiquid nature of private markets may not suit the needs of retail investors, who want to cash out as easily as they do in public markets. Private market investors are expected to hold the asset for years because of the long lock-up period in exchange for a premium, which is quite different from the daily trading in public markets. Even secondary market activities are extremely limited as the private market favours “illiquidity premiums, price stability, small lending groups, and discretion”, Moody’s says.

As such, retail investors are significantly vulnerable to market rout as cash, for instance, can be completely inaccessible during market stress.

“If [market stress] happens, and consumers are hurt, this could lead to reputation loss, heightened regulatory scrutiny, and higher costs,” the report says.

“In addition, any misalignment of liabilities and assets can jump to the surface during times of market stress – with systemic implications when this stress spreads across multiple funds with similar strategies. In such a situation, there would be more limited liquidity access across the system – further hurting asset prices.”

Asset valuation is another barrier to profit-taking in the private market as it doesn’t benefit from real-time market pricing. The lack of professional knowledge increases concentration risk and restrains retail investors from assessing underlying values, and signs of market downturn may wrong-foot them on redemption and arbitrage.

The change of investment behaviour brought by retail influx can upend the private market, Moody’s observes. Private credit, for instance, is more prone to narrow spreads and riskier lending behaviour.

Still, retail involvement is unavoidable given the private market is sitting on US$4.2 billion in dry powder, says the report. Therefore, innovations and collaborations among asset management firms will have to come into play to provide investment solutions that suit the needs of retail investors.

Asset managers will have to do the spadework, including educating investors and beefing up liquidity to cushion the impact of wild market swings on investors. Also, managing risk appetite and sourcing quality investments are essential for the safe and stable growth of private markets.

“Managers are likely to deepen their focus on advisor-led solutions, digital platforms, and investor/adviser education, all of which are essential to scaling access while reinforcing suitability,” the report says.