Tokenized short-term liquidity funds, including tokenized money market funds and similar short-term, cash-like bond funds, are emerging as a critical component of the financial system that bridges traditional finance and decentralized finance. The funds provide a liquid and safe yield enhancement solution for digital asset holders.

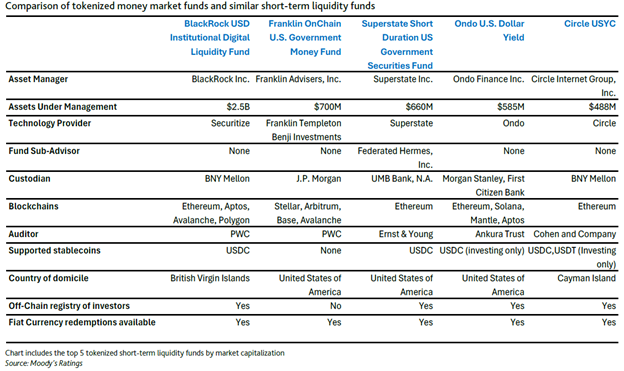

Since their launch in 2021, tokenized short-term funds have grown to US$5.7 billion in assets under management ( AUM ) as of June 2025, according to a recent report from Moody’s.

These funds provide yield and serve as a more efficient liquidity management vehicle for digital asset investors who hold stablecoins like USDT or USDC, which typically do not offer interest. While stablecoins can be considered digital cash, tokenized money market funds function more like savings accounts for digital assets.

Tokenized short-term funds operate similarly to traditional, highly safe and liquid money market funds, but with one key difference: their share registries are maintained on a blockchain ledger. This enables greater transparency, flexibility, and functionality. In most cases, these funds are backed by US treasury money market instruments, which are widely regarded as safe assets suitable for collateral and liquidity management.

Tokenized short-term funds offer more flexibility than traditional money market funds. They can be traded in both fiat currencies and stablecoins, opening the door to both traditional and crypto investors. Additionally, instant 24/7 settlement provides greater efficiency compared to traditional money market funds, which typically settle on a T+1 or T+2 basis.

Staking vs tokenized funds

Staking is a process in cryptocurrency where users lock their coins in a wallet to help validate transactions on a blockchain network, earning rewards in return. In simple terms, it’s a form of passive income, allowing crypto investors to earn without actively trading. According to recent data from OKX, the annual return from staking USDT and USDC is around 5%, while Bitcoin and Ethereum offer much lower returns of 1% and 1.5%, respectively.

The Superstate Short Duration US Government Securities Fund offers qualified purchasers access to short-duration treasury bills. The current yield is around 4.3%. Tokenized money market funds give digital asset investors access to one of the safest real-world assets – US treasury bills – providing both liquidity and safe yield enhancement.

Hong Kong is playing a leading role in the digital asset space, aligned with its ambition to become Asia’s digital asset hub. In February 2025, China Asset Management ( Hong Kong ) Limited launched Asia-Pacific’s first HKD digital money market fund, designed specifically for retail investors, with a minimum investment of just HK$10. In April, Bosera Asset Management ( International ) Co, Limited also launched both an HKD money market ETF and a USD money market ETF, further expanding product offerings in this space.

Outlook bright but risks remain

The AUM of tokenized money market funds is expected to grow significantly. Most major wealth brokerages, private banks, and asset management platforms that offer digital assets, according to Moody’s, will likely adopt cash-sweep products, such as tokenized short-term liquidity funds, to automatically move uninvested cash into yield-earning vehicles.

McKinsey & Company projects that asset tokenization could reach US$2 trillion by 2030, with tokenized short-term liquidity funds likely to serve as a core foundational product supporting the liquidity needs of this evolving sector.

Despite the many benefits, tokenized short-term funds do not eliminate fundamental risks such as potential loss in value or liquidity issues during market downturns, according to Moody’s. Moreover, they face new operational risks associated with blockchain technology, including network availability, scalability limitations, and security vulnerabilities.